FIRA USA, the ultimate gathering for ag robotics geeks, just wrapped, and I’m playing major email catch-up. If we didn’t get to chat at FIRA and you’re an agricultural robotics company, get on my calendar here. While at FIRA, I got to present some trends on agrifood tech investment to CDFA. In pulling together that presentation, I got the chance to parse through all of the agrifoodtech funding reports of the past couple of years. I got caught up in the details around equipment and robotics funding, which, despite the hype cycles that we’re so used to seeing in most of VC, has remained pretty slow and steady.

I grew up racing turtles every August in Longville, MN, the Turtle Racing Capital of the World. Turtle racing is pretty simple. You hold your turtle and stand in the middle of two concentric circles in the middle of the main (single) street in Longville with a dozen other sweaty kids and their turtles (which you’ve all rented from the Turtle Race Authorities…don’t ask too many questions.) An enthusiastic old man is MCing the event, and when he says go, you and the other racers place your turtle on the edge of the inner circle, and the first turtle who reaches the outer edge of the bigger circle ends the races and wins the Speedy Award. There are always a few turtles who go the dead wrong direction, or who go a couple feet and just stop. The turtle at the end of the race who is closest to the center of the circle wins the Slow Poke Award. Both awards come with a free ice cream cone at Frosty’s, the only ice cream store in town (and “town” is a generous term for a single street.) I’m proud to report that I’m at least a 3x winner of the Slow Poke Award (=🍦🍦🍦.)

Is this in any way relevant to robots and agriculture?

It’s obviously a stretch, but it immediately came to mind when I looked at “Farm Robotics, Mechanization & Other Farm Equipment” investment in the below chart, and it’s such an absurd thing that I couldn’t bring myself to cut it. Also, I used the the title “Slow and Steady” in my last post, so I had to come up with something different.

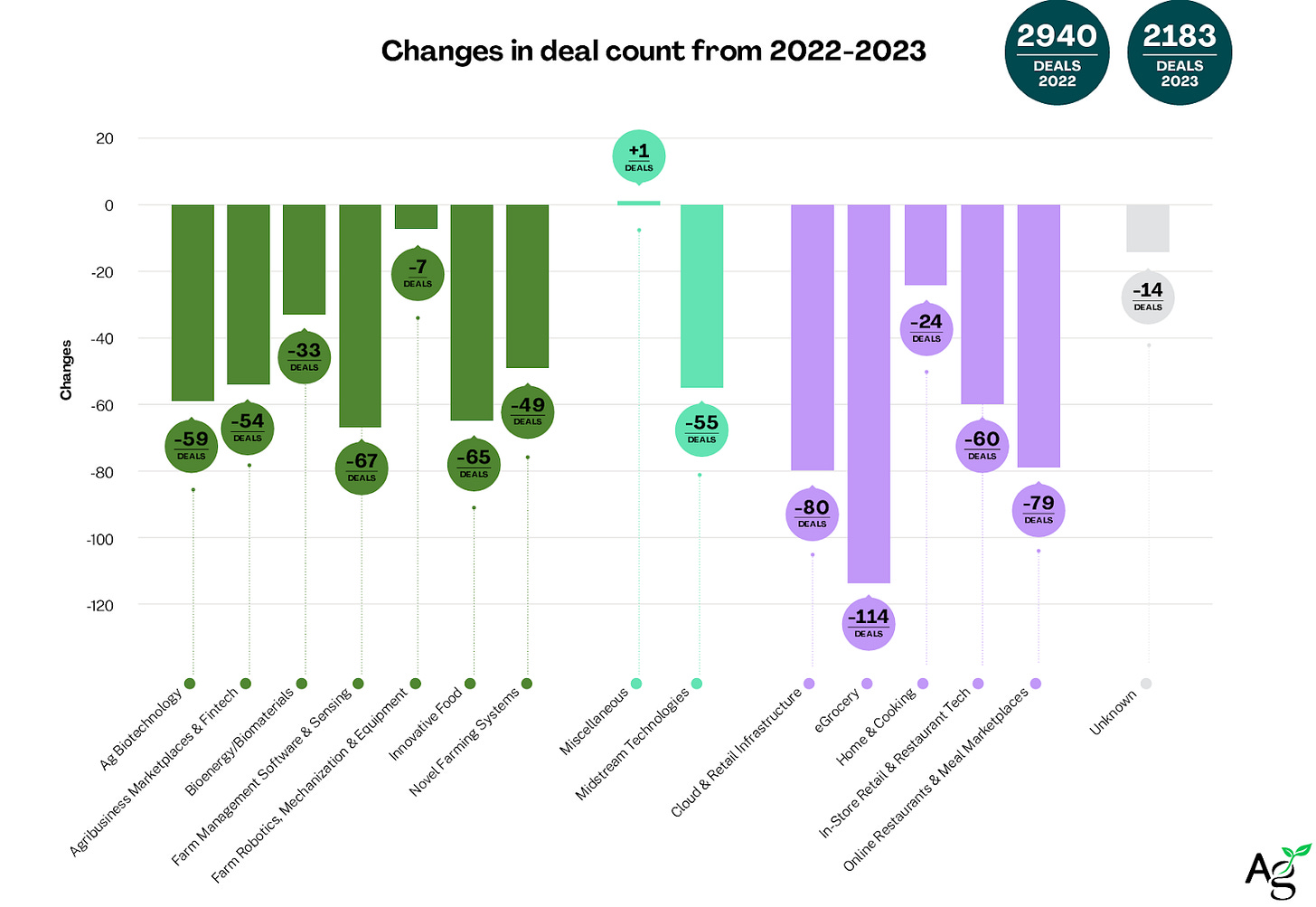

Investment in ag equipment is low, slow and steady. In a year where agtech funding dropped precipitously, ag equipment investment increased a little tiny bit. Why?

Next Gen Ag Equipment Co’s have solid fundamentals.

In a time where investors are going back to the basics and looking for companies that can generate sales, revenues, and ultimately reach profitability, physical stuff that solves problems for farmers just makes sense. As much as VCs love software, farms don’t spend much money on it. They do spend a lot of money on equipment. Equipment that alleviates the pressures of high wages, reduced labor availability, and increasingly volatile working conditions is useful and worth investing in from a farm operator perspective. Market risk is low and market availability is obvious.

Hardware is for the hardcore.

Only true believers are investing in equipment. We understand that fundamentally, you can’t do stuff without stuff. We didn’t get into investment for a shiny, flash-in-the-pan trend. The agricultural labor crisis is a long term investment opportunity, and it will not be solved without investment in equipment. CVCs tied to OEMs aren’t going to stop selling equipment, and their customers won’t stop buying. They’ll be investing in this space forever.Everyone loves toys

There are a few VC funds who opportunistically sprinkle one or two robotics investments into their portfolios, and that will keep happening. Being able to see and feel a product is fun. Most VC funds have at least one resident nerd, and c’mon, who doesn’t have a soft spot for R2D2 or Wall-EE? Farmers are no different - most of them have emotional connections to their tractors and equipment brands, and every now and then, they add to their collection.

I predict that ag equipment venture investment is going to continue to be slow and steady. I think it would be wise for more VC funds, be they agrifoodtech, climatetech, or pure generalist, to sprinkle in a higher rate of probable doubles and triples instead of shooting for the moon each time, especially in today’s environment of lower valuations. Power-law-or-bust portfolio construction doesn’t work in ag. That said, the simplified fundraising narrative of “I’m going to become a billionaire, quickly, who wants in?” works. (Even though it’s a very stretchy version of “truth.”) Too few people managing funds will ever spend time really doing the work in fields like agriculture to actually understand the reality of the space, so, there won’t be a massive spike in VC funding for equipment.

That said, I do predict that ag equipment risk capital investment is going to increase, at least a little bit (hopefully not so much that it gets hypey.) Why?

It’s a big + growing market opportunity. Ag equipment is a $180B+ global market and labor is a $45B+ market opportunity in the US alone. At the same time, it’s going to take a while to get companies up and running, and fragmentation by crop type, geography, and practice types are going to continue to constrain valuations, limiting the opportunities for VCs seeking unicorns. Keep track of Mixing Bowl Hub’s Crop Robotics Landscapes to see the growth in numbers of startups in the space.

The labor crisis in US agriculture is a domestic security risk.

This risk is so severe that the government will interfere. Our trade ratio is going the wrong direction right now, and there’s nothing in place to change that right now. The solution is single-use, collaborative robotics, aka, next generation ag equipment. These products need to be affordable (if artificially via subsidies, which is not outside the realm of possibility.) The USDA and state departments of ag should and will increasingly issue grants like Farm Labor Stabilization and Protection Pilot Grant Program that lessen the burden of rising labor costs. I expect we’ll see more of this.

These companies create great jobs, often in rural regions.

Advanced manufacturing and equipment servicing jobs are high quality, well paying career opportunities. Retaining and revitalizing rural communities is essential for the health and happiness not just of farmers and rural residents, but for all citizens. Hardware construction and servicing is inherently place-based work, which can enhance connectivity and relationship strengthening in and between rural communities.

Without sticky equipment, there’s no high quality data source and a limited opportunity for AI

Throughout the entire history of agtech, we’ve been talking about this futuristic world of “precision agriculture.” The way we’ve mostly gone about trying to create that world is by trying to sell farmers or channel partners some version of “pay me to capture data points x, y and z, and hopefully someday I’ll turn those random data points into something useful for you.” Tough sell. It’s much easier to say: “I have a piece of equipment that alleviates a major paint point for you by increasing the efficiency of your workforce.” That equipment can then pull telemetric data and unlock “big data” in ag in the future, without putting the cost of capturing that data directly on the customer.

I suspect we’ll see more Slow Poke awards than Speedy awards in the future of next gen ag equipment investment, and that’s just fine with me.

Not for Everyone. But maybe for you and your patrons?

Dear Connie,

I hope this finds you in a rare pocket of stillness.

We hold deep respect for what you've built here—and for how.

We’ve just opened the door to something we’ve been quietly handcrafting for years.

Not for mass markets. Not for scale. But for memory and reflection.

Not designed to perform. Designed to endure.

It’s called The Silent Treasury.

A sanctuary where truth, judgment, and consciousness are kept like firewood—dry, sacred, and meant for long winters.

Where trust, vision, patience, and stewardship are treated as capital—more rare, perhaps, than liquidity itself.

The two inaugural pieces speak to a quiet truth we've long engaged with:

1. Why we quietly crave for 'signal' from rare, niche sanctuaries—especially when judgment must be clear.

2. Why many modern investment ecosystems (PE, VC, Hedge, ALT, SPAC, rollups) fracture before they root.

These are not short, nor designed for virality.

They are multi-sensory, slow experiences—built to last.

If this speaks to something you've always felt but rarely seen expressed,

perhaps these works belong in your world.

Both publication links are enclosed, should you choose to enter.

https://tinyurl.com/The-Silent-Treasury-1

https://tinyurl.com/The-Silent-Treasury-2

Warmly,

The Silent Treasury

Sanctuary for strategy, judgment, and elevated consciousness.